Rent With Confidence

MyRental™ offers tenant screening solutions to landlords, real estate agents, and property managers so that they can identify qualified applicants.

START SCREENINGRent With Confidence

MyRental™ offers tenant screening solutions to landlords, real estate agents, and property managers so that they can identify qualified applicants.

Thoroughly Screen Your Tenants

Help mitigate the risk of expensive evictions and property damage by screening your applicants. The best part is that all of this is free to you with the applicant pay option.

- Credit Report

- Housing Court Data and Address History

- Multi-state Criminal

- Multi-state Sex Offender

- TU Rental Score

.png)

SafeRent Score is More Than a Credit Score

The three-digit score summarizes the potential risk of the applicant compared to others. Higher scores predict better tenants

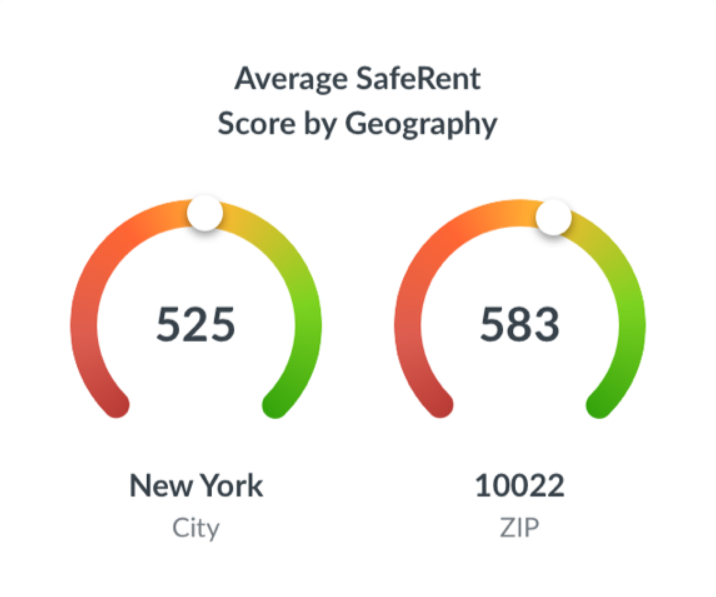

See what other landlords are doing in your area

Compare your applicant’s score with average scores in the area

Our proprietary SafeRent Score helps identify tenants who are more likely to pay rent on time, treat the property with care, and stay for longer periods of time. Because it is based on analysis of key rental data, it is more reliable than a standard credit score for evaluating your applicants.

The three-digit score summarizes the potential risk of the applicant compared to others. Higher scores predict better tenants

Compare your applicant’s score with average scores in the area.

See what other landlords are doing in your area

Lease Performance

The TU Rental Score evaluates potential renters throughout the country using data and analytics, and assigns an easy-to-understand three-digit score—from 350 to 850.

Powered

by Hard Data

- Collection records

- 17,000,000 eviction court records

Analyzed

by Our Algorithm

The score results from an alogrithm by SafeRent that uses mathematical analysis of information found in tenant screening reports, rent to income ratio, and subprime records.

Creating an Advanced

View of Risk

The three-digit score summarizes the potential risk of the applicant compared to others. Higher scores predict better tenants.

Free Online

Rental Application

Go Paperless

Applications can be sent and received on any computer or mobile device.

Save Time

Simplify the rental process for applicants and landlords.

Add an Optional Screening

You can request a tenant screening alongside or after an application is submitted.

Start Screening

Free Online

Rental Application

Go Paperless

Applications can be sent and received on any computer or mobile device.

Save Time

Simplify the rental process for applicants and landlords.

Add an Optional Screening

You can request a tenant screening alongside or after an application is submitted.

CoreLogic is a Leading Tenant Screening Provider in the US Serving Over 10M Reports per Year

Trusted by

Featured Packages

No sign-up fees. No monthly fees.

Basic

$24.99

per applicant

applicant pay option not available

Our basic affordable package featuring screening reports such as:

- Housing Court Data

- Additional Address Information

- Multi-state Criminal

- Multi-state Sex Offender

- Terrorist Check

Premium

$37.99

per applicant

Free for landlord

applicant pays $37.99

The most comprehensive screening package that includes everything in basic:

- Housing Court Data

- Additional Address Information

- Multi-state Criminal

- Multi-state Sex Offender

- Terrorist Check

- Everything in Basic Package

In addition, you are getting:

- Credit Report

- TU Rental Score

Rental Application

Free

per applicant

Give your prospective tenants a free, mobile-friendly way to submit applications online.

Contact Us

Client Services:

M-F 7:30 a.m. to

6:00 p.m. CST

800-811-3495

Consumer Support:

M-F 8:00 a.m. to

6:00 p.m. CST

888-333-2413

Sales/Demo:

M-F 7:30 a.m. to

6:00 p.m. CST

800-811-3495

Request a Partnership

Sign up today for a demo. Demos are for partnership opportunities for Brokers, MLS and Marketing Affiliates.

eBook