—U.S. single-family rent prices increased 2.9% year over year

in January 2020—

- For the 14th consecutive month, Phoenix had the highest year-over-year rent price increase at 6.4%

- Lower-priced rentals experienced increases of 3.5%, compared to gains of 2.6% among higher-priced rentals

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and among 20 metropolitan areas. Data collected for January 2020 shows a national rent increase of 2.9% year over year, down slightly from a 3.2% year-over-year increase in January 2019. Rent prices are now increasing at double the rate of inflation, presenting affordability challenges among current and prospective renters.

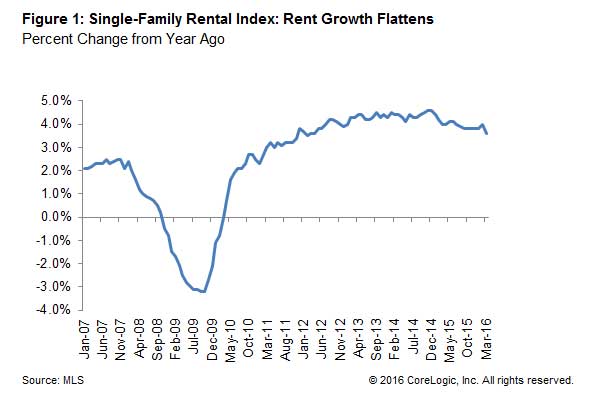

Low rental home inventory, relative to demand, fuels the growth of single-family rent prices. The SFRI shows single-family rent prices have climbed between 2010 and 2019. However, overall year-over-year rent price increases have slowed since February 2016, when they peaked at 4.2%, and have stabilized at around 3% over the past year.

Low-end rentals propped up national rent growth in January, which has been an ongoing trend since May 2014. Rent prices among this tier, defined as properties with rent prices less than 75% of the regional median, increased 3.5% year over year in January 2020, down from a gain of 3.9% in January 2019. Meanwhile, high-end rentals, defined as properties with rent prices greater than 125% of a region’s median rent, increased 2.6% in January 2020, down from a gain of 2.9% in January 2019.

Among the 20 metro areas shown in Table 1, and for the 14th consecutive month, Phoenix had the highest year-over-year increase in single-family rents in January 2020 at 6.4% (compared to January 2019). Tucson, Arizona experienced the second-highest rent price growth in January 2020 with gains of 5.2%, followed closely by Las Vegas at 4.9%. Honolulu experienced the lowest rent increases out of all analyzed metros at 0.6%.

Metro areas with limited new construction, low rental vacancies and strong local economies that attract new employees tend to have stronger rent growth. Phoenix experienced the highest year-over-year rent growth in January 2020, driven by annual employment growth of 3.2%. Austin, Texas experienced a 3.6% employment growth, which played a role in its above-average rent growth of 3.4% in January. This is compared with the national employment growth average of 1.5%, according to data from the United States Bureau of Labor Statistics.

“The single-family rental market benefited from low unemployment rates over the past year, resulting in an increase in rental demand,” said Molly Boesel, principal economist at CoreLogic. “However, rents are increasing at about double the rate of inflation, which has negatively impacted affordability.”

Methodology

The single-family rental market accounts for half of the rental housing stock, yet unlike the multifamily market, which has many different sources of rent data, there are minimal quality adjusted single-family rent transaction data. The CoreLogic Single-Family Rent Index (SFRI) serves to fill that void by applying a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. CoreLogic constructed the SFRI for over 80 metropolitan areas —including 45 metros with four value tiers—and a national composite index.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Allyse Sanchez at corelogic@ink-co.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Posted by Allyse Sanchez, INK Communications 4:00:38 PM

As a landlord, how well you screen your tenants can have a big impact on your finances. The ideal tenant pays you on time, causes no problems, and leaves the rental unit in great shape when they leave. A bad tenant can keep you up at night wondering what problems they'll cause next and leave you with a large clean up bill due to damaged property. Proper tenant screening can help you to increase the odds of each of your tenants being an ideal renter.

Reduce Your Risk By Conducting Thorough Tenant Screening

Take the time to do a complete screening on every applicant. This will weed out the people who increase your risk of having to deal with one or more of the following problems:

Payment issues - These tenants can have an excuse for why they can't pay on time, or can't afford to pay the entire amount. They may take advantage of you and delay paying as long as they can. This makes your budgeting impossible to do accurately.

Damage issues - Unless you have an annual inspection policy, you're likely not going to see the inside of a unit until the tenant moves out. An irresponsible tenant can leave you with ruined carpets, damaged walls and ceilings, and broken sinks and toilets.

Screen for All Potential Risks

A thorough screening uncovers the financial risks and behavioral issues that a tenant may bring to your complex. A complete screening process takes time but will save you money if you don't to deal with rental issues. Many successful property managers rely on tenant screening services to do these checks into a tenant's rental history. If you do them yourself, make sure you cover all of the following areas:

The Online Rental Application- This is the initial source of information you need from a prospective tenant to determine if they are a good risk as a renter. This information is the starting point for the various checks you'll do to research the tenant and is useful to any service you use to perform those checks for you.

The Credit Check- The information lets you see the current financial status of the tenant as well as any issues in their credit history that may be a red flag for renting to them. Because this is a critical part of the tenant evaluation process, some property managers make use of a rental credit check service to make sure they get accurate information.

The Rental History Check- Another important part of the process is looking at the tenant's history with previous landlords. A rental history report will show if there were issues with the tenant paying on time or any history of property damage.

Because this requires contacting previous landlords to get the information, using a service to get the rental history reports will save time and frustration, should you have difficulty connecting with a landlord. You'll get accurate information to answer your questions about a tenant's renting behaviors.

Sorting the Information

Collecting all of this information is just half the battle; the other half is reviewing it so you can determine how big a risk an applicant is as a renter. If you manage a small number of units or have very low turn over, you may find that a tenant screening service is worth the time and money. They can provide you information for your tenant background check, credit check and rental history.

A good tenant screening service will provide you with a tenant score. This will indicate how likely the applicant is to default on a lease, which can save you time and money in the longrun.

Posted by Admin 10:26:37 AM

Odds are high that many of your applicants have been evicted or fought to stop an eviction. Each year, approximately one million evictions are filed and 1 in 40 renters get evicted. Some of these renters bounce back from the eviction process and become reliable tenants, while others couch hop for years before applying at your property.

Posted by Admin 2:05:58 PM

As a landlord, one of your biggest fears is having a property that sits empty for weeks or even months. Every day that rolls by marks another dip in your bank account. That said, the last thing you want to do is rush in a new tenant only to discover they’re stuck in a financial quagmire or have a long history of trashing homes and failing to pay rent. Plus, losing a tenant (even if you’re ready for them to go) brings its own slew of budget-busting costs beyond lost rent, including marketing and administration fees, screening costs and potential maintenance or required upgrades.

Posted by Admin 9:17:08 AM

US SINGLE-FAMILY RENTS UP 3.1 PERCENT YEAR OVER YEAR IN DECEMBER

- Rents increased 3 percent for the full year 2018.

- High-end segment rent growth accelerated and low-end segment decelerated in December 2018 compared with December 2017.

- Houston had the slowest annual rent increase of the 20 analyzed areas in December.

U.S. single-family rents increased 3.1 percent year over year in December 2018, up from a 2.9 percent increase in December 2017, according to the CoreLogic Single-Family Rental Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. Single-family rents climbed steadily between 2010 and 2018. Annual rent increases have stabilized, fluctuating between 2.7 and 3.2 percent for the past 12 months. Rent increases averaged 3 percent for full year 2018, a pick up from 2.7 percent in 2017.

Posted by Admin 10:43:44 AM

US SINGLE-FAMILY RENTS UP 2.9 PERCENT YEAR OVER YEAR IN NOVEMBER

- High-end segment rent growth accelerated and low-end segment decelerated in November 2018 compared with November 2017.

- Seattle rents decreased in November.

Posted by Admin 8:59:40 AM

The key to comprehensive evaluation of risk is thorough evaluation of the resident, property and portfolio. Unlike rules or judgment based tools or methodologies, CoreLogic® scoring and analytics tools give a forward- looking view of many key factors that impact future resident, property and performance—including the likelihood of residents paying rent on time and honoring their lease obligations.

Posted by Admin 10:25:23 AM

While some consumers might question the safety of investing in real estate, purchasing rental property is traditionally a fortuitous opportunity and long-term investment for buyers and property owners. And, for those willing to take the plunge, there are several highly sought-after markets throughout the country that may offer strong and sound real estate investments—either through a traditional home purchase or buying a rental property.

Posted by Admin 11:59:31 AM

New Single-Family Rental Index from CoreLogic Shows Slower Single-Family Rent Growth

Given the growing role that rental properties are playing in real estate, CoreLogic has developed a new Single-Family Rental Index (SFRI) to measure the changing rent dynamics of single-family rental properties. The index, which uses a methodology similar to our own CoreLogic Home Price Index (HPI), as well as the CoreLogic Case-Shiller Index, measures changes in rents by comparing repeat leases on the same single-family properties. The index allows us to track the changes in rents while controlling for the mix and quality of single-family rental properties, which is a very important and unique feature of the index.

Posted by Admin 12:53:54 PM

Nationally and at the Metro Level, Google Searches Correlate with Rental Prices

In Part I of this blog we discussed how Google Trends1 can provide insights into rental prices at the national level. Here we focus on the correlation between Google Trends and real rental prices for a few large metros. As with the national level analysis, structural time series models were used to extract the long-term trends from Google search interests, and real rental prices-per-square-foot were normalized to get real rental price appreciation since January 2012. Read More

Posted by Admin 11:20:02 AM

What people are saying about us